Amius Group Limited Pillar 3 Disclosure as of 30 September 2017

Introduction

The Capital Requirements Directive (CRD) and the Capital Requirement Regulation (CRR) (collectively “CRD IV”) implements the Basel III agreement in the EU and establishes a regulatory framework consisting of three “Pillars”:

Pillar 1 sets out the minimum capital required to meet a firm’s credit, market and operational risk;

Pillar 2 requires a firm to establish an Internal Capital Adequacy Assessment Process (“ICAAP”) to assess whether its Pillar 1 capital requirement is sufficient to cover the risks faced by the firm, and if not, to calculate the additional capital required; and

Pillar 3 requires a firm to disclose specific information concerning its risk management policies and procedures and its regulatory capital position.

Amius Group Limited (“Amius”) is a BIPRU firm and therefore required to comply with CRD IV which has been implemented in the UK in the Prudential Sourcebook for Investment Firms (IFPRU) and Banks, Building Societies and Investment Firms (BIPRU), the latter of which specifically applies to Amius.

This document therefore contains the disclosures Amius are required to make in accordance with BIPRU 11.

Disclosure Policy

In accordance with BIPRU 11.3.3, Amius has adopted a formal policy to comply with the disclosure requirements of Pillar 3 and has policies in place for assessing the appropriateness of its disclosures including verification and frequency.

Amius has relied on BIPRU 11.3.5 and 11.3.6 to exclude information we consider to be immaterial, confidential or proprietary in nature and will make these non-disclosures clear.

In accordance with BIPRU 11.3.8, Amius will publish this disclosure annually on its website.

Scope of application

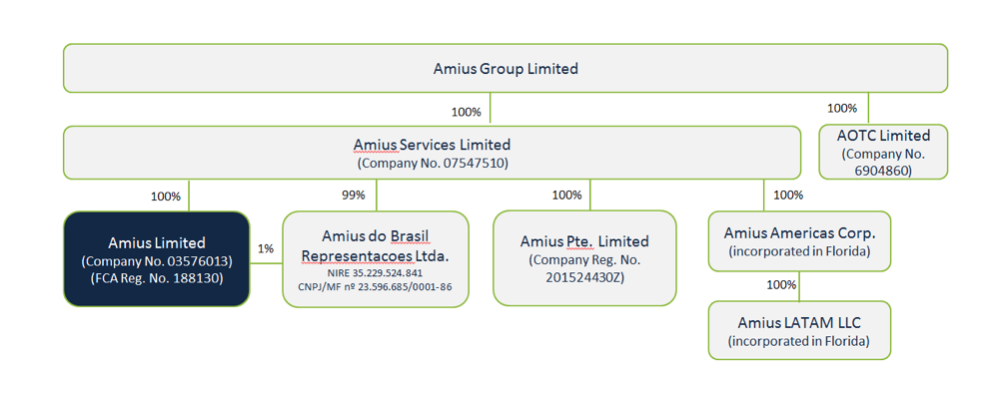

As of the reporting date Amius, comprises the following entities:

- Amius Group Limited – a UK holding company which employs all of Amius’ UK based staff

- Amius Services Limited – consolidation point for accounting purposes

- AOTC Limited – dormant entity

- Amius Limited – an FCA regulated entity (FRN 188130) which specialises in providing Over-the-Counter (OTC) risk management structures and execution services to the commodity sector.

- Amius do Brasil – Brazil sales representative office

- Amius Pte Limited – Asia sales representative office and proprietary trading entity

- Amius Americas Corp – consolidation point for US tax purposes

- Amius LATAM LLC – sales representative office for LATAM region

For the purpose of BIPRU 11.5.2, all of the above entities are fully consolidated for reporting purposes and are disclosed at the Group Level in the Pillar 3 disclosure. They will collectively be referred to as “Amius” in this report.

There are no current or foreseen material, practical or legal impediments to the prompt transfer of capital resources or repayment of liabilities between any of the Amius entities.

Risk Management Objectives and Policies

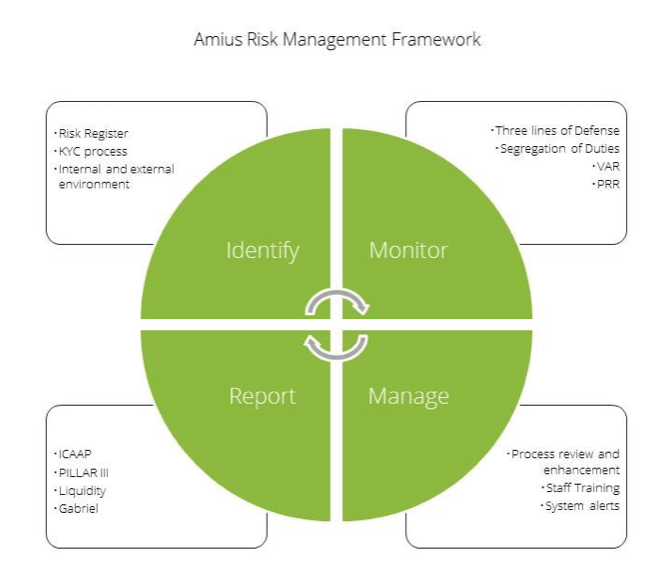

Amius’ Risk Framework has been designed to ensure risks are being appropriately identified and managed in line with Amius’ risk strategy, appetite and objectives. The Framework also provides a formal structure from which controls such as policies, reporting and monitoring, can develop. The Framework incorporates five components:

- Risk identification, which allows Amius to consider the risks to which it is exposed and give them appropriate weighting;

- Risk measurement, which provides information on the quantum of a specific risk exposure or risk exposures in aggregate;

- Risk mitigation, which allows Amius to apply controls to various identified risks and consider their effectiveness;

- Risk reporting, which provides information on specific or aggregate risks on a periodic basis; and

- Risk governance, which ensures that Amius employees have clearly defined roles which allow them to monitor for risks and perform their duties in accordance with the Framework.

Structure and organisation of the risk management function

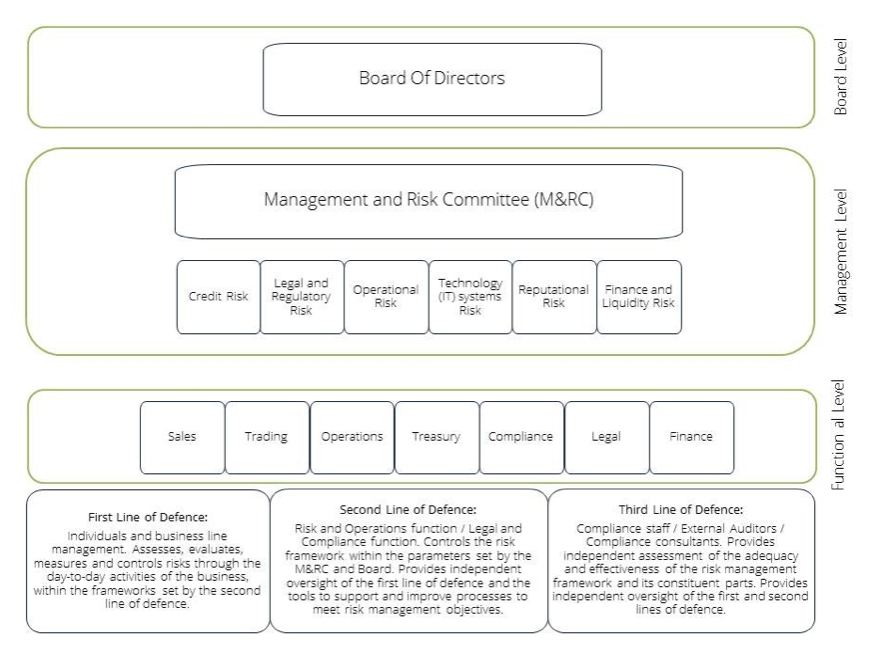

Amius operate a “Three Lines of Defence” model which ensures risk accountability at all levels of the risk management structure.

Board of Directors

Amius’ Board of Directors is comprised of:

- Chief Executive Officer;

- Chief Technology Officer; and

- Chief Financial Officer

The Board is collectively responsible for:

- setting an appropriate risk strategy and appetite;

- promoting a comprehensive risk culture and awareness;

- monitoring the implementation of the risk strategy;

- ensuring the independence of the control functions such as Compliance and Risk; and

- verifying that independent control functions operate correctly and effectively.

The Board has delegated the implementation and oversight of all risk matters to the Management and Risk Committee (“M&RC”).

Management and Risk Committee

Amius’ M&RC play a lead role in the integration of the risk management framework and risk culture of the organisation. The Committee is led by the CEO and attended by the CTO, CFO, and Heads of Sales, Operations & Risk and Compliance.

Risk Reporting and Measurement

Amius employs comprehensive processes to ensure the monitoring and reporting of risks within its Risk Framework.

Control Environment: clearly articulated risk appetite, objectives and management philosophy which is affirmed by management and staff through a robust governance structure with clear accountability at each stage.

Risk Assessment: identifying risks and links between risks, analysing their likelihood and impact which allows for implementation of suitable controls.

Controls: which include policies and procedures, Operational Review, reporting, verification and reconciliations, segregation of duties

Information and Communication: use of both internal and external information relating to the assessment of risks and their controls which is communicated both formally and informally in a timely manner.

Monitoring: of the effectiveness of the risk framework, improving practices and aligning with best practices.

Risk Categories

Credit risk

Credit risk is the risk of loss that Amius will incur if a client or counterparty fails to perform its contractual obligations. Amius’ credit risk exposure with clients is mitigated against through a rigorous credit risk assessment of clients, following which limits are imposed which are monitored and reviewed.

Market risk

Market risk is the risk of losses Amius may incur in respect of its positions arising from adverse movements in market prices of underlying contracts traded. Amius utilise a number of reports to assess its live market risk exposures and mitigate against this risk through extensive stress testing and, where necessary, the imposition of risk reduction strategies when limits (both internal and external) are deemed to be close to an agreed risk tolerance limit.

Liquidity Risk

Liquidity risk is the risk that Amius may not be able to meet its obligations when they fall due. Liquidity risk is monitored through a daily cash report setting out the current liquidity position, major cash events, and short and medium term commitments. Liquidity risk is mitigated against through the use of a number of key indicators which assess actual and projected cash usage, including client position exposure, expected margin exposure, and short and medium term commitments. Transactional liquidity stress analysis is also carried out to determine the level of cash reserves Amius should maintain.

Operational Risk

Operational risk is the risk of loss resulting from inadequate or failed internal processes, people, systems or from external events. This excludes business, strategic and reputational risks. Amius seeks to minimise operational risks through internal risk management processes and business controls, segregation of duties and system controls that ensure a secure operational environment.

Legal & Regulatory Risk

Legal and Regulatory risk is the risk of not complying with existing laws and regulations or the adverse or material impact of a change in laws or regulations on the business. Legal & Regulatory risks are mitigated against through the use of in-house and external counsel who closely monitor and advise on regulatory developments, updating the business through regular training and improvements in procedures.

Strategic & Business Risk

Strategic and business risks are those arising from Amius’ business strategy and strategic objectives including the risk of failing to meet these objectives or execute the strategy successfully. Amius seek to mitigate against this through fortnightly Business and Strategy meetings during which the M&RC discuss strategy, new products and ventures and the latest competitor, technological, market and regulatory developments and how these may affect the strategy.

Foreign exchange risk

Amius is exposed to foreign currency risk that arises through its revenue generation. Revenue is principally earned in USD and to a lesser degree in other currencies. Foreign currency risk is analysed and managed by the monitoring of all material foreign currency exposures, and hedges are undertaken on a forward and spot basis where necessary by the Treasury department.

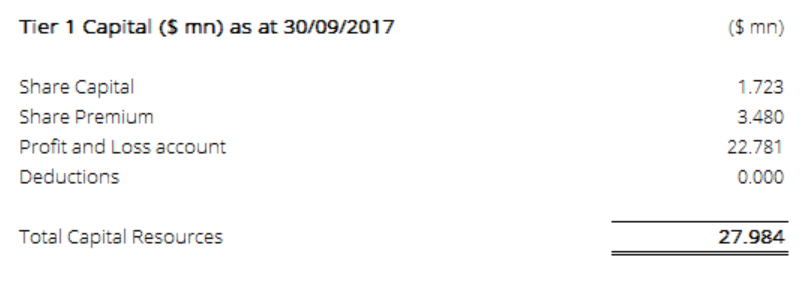

Capital Resources

Amius’ Tier 1 capital consists of ordinary share capital and retained earnings. Amius’ total capital resources as at 30 September 2017 is $27.984 million

In accordance with BIPRU 11.5.3, Amius does not hold hybrid capital and capital instruments. Furthermore, Amius does not hold intangible assets.

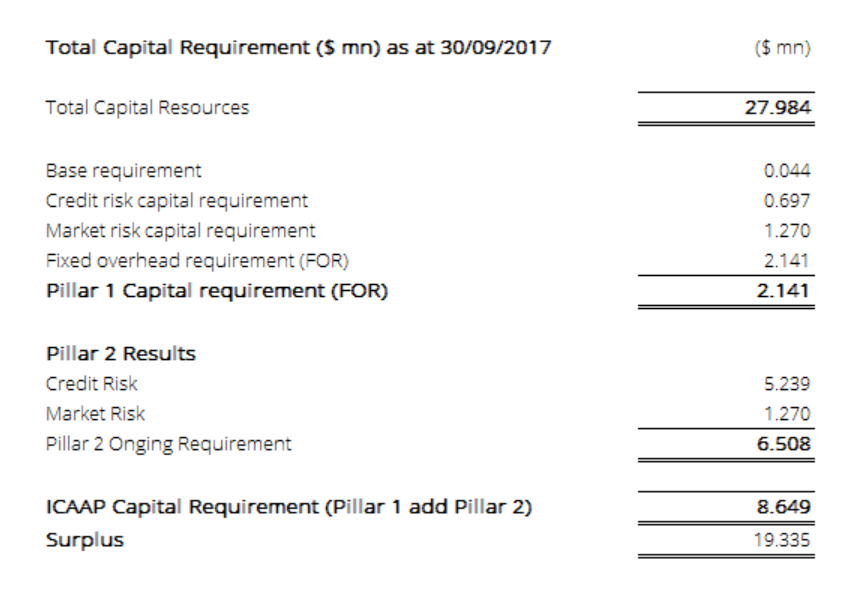

Total Capital Requirement

Amius is a BIPRU EUR €50k limited license firm and strictly operates on a Matched Principal basis. Amius calculates its Pillar 1 capital in accordance with GENPRU 2.1.41 and 2.1.45 and considers additional capital requirements under Pillar 2, which predominantly include credit risk and market risk.

In accordance with BIPRU 11.5.4, Amius monitors the adequacy of its internal and regulatory capital as part of its monthly management information. This regular review process, combined with stress testing of liquidity balances, ensures that Amius has sufficient resources to support current and future activities.

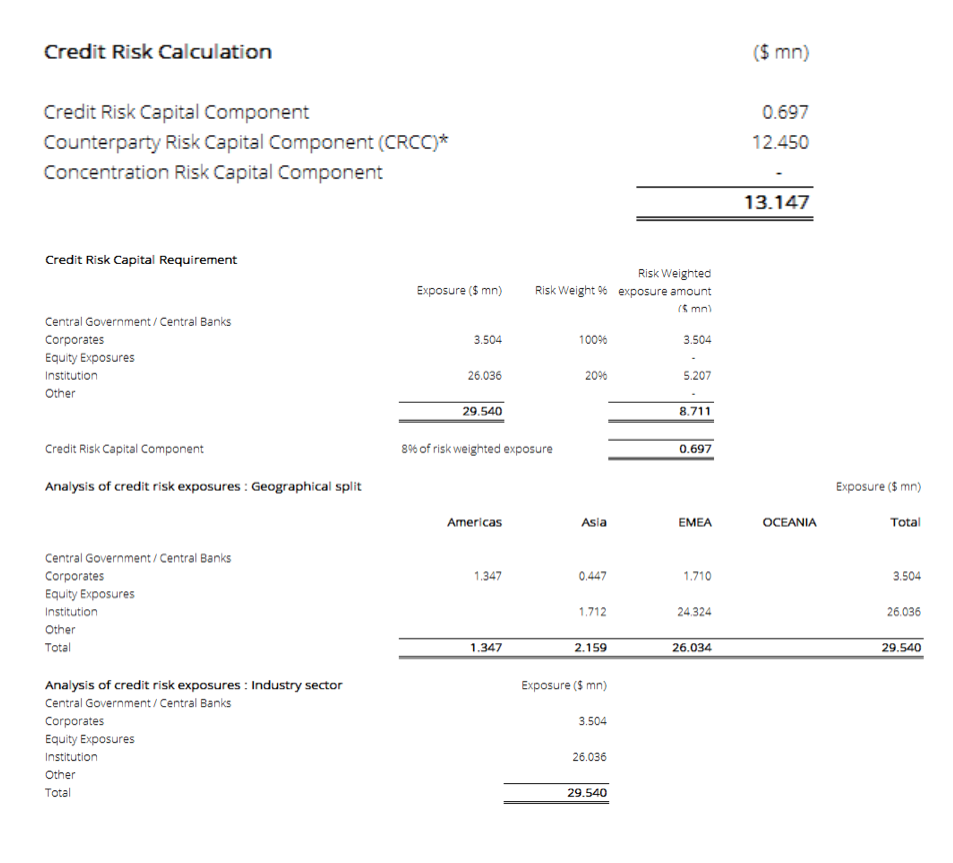

Credit Risk Capital Requirement

Amius has adopted the standardised approach to the calculation of Credit Risk.

A detailed credit risk assessment is carried out for all clients and trading counterparties as well as for banks and brokers used by Amius. Counterparties are analysed and scored and credit limits are approved after careful consideration only. Exposures are being managed and mitigated against on a case by case basis, stress tests on exposures are carried out daily, and risk mitigation measures include margining of positions, the use of collateral and insurance.

In accordance with BIPRU 11.5.7(5), Amius is able to rely on netting benefits, as documented in its Terms of Business or other relevant industry standard legal documentation (ISDA) governing client and counterparty relationships, which allow Amius to calculate net derivative credit exposure and apply collateral held, thereby further mitigating counterparty credit risk.

The analysis of Risk Weighted Exposures as at 30/09/2017 is detailed below:

*Whilst Amius calculates the counterparty credit risk for regulatory reporting obligations under FCA guidelines, it is not applicable to Amius as it is not a BIPRU4 classified entity, and is thus not included in its Pillar 1 capital requirement.

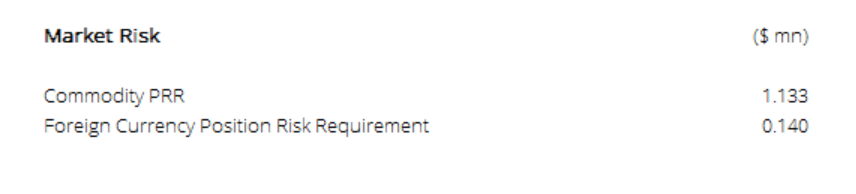

Market Risk Capital Requirement

As Matched Principal, Amius is required to calculate a Market Risk Capital Requirement on its trading positions to ensure it remains within the scope of its permissions. In accordance with BIPRU11.5.12, Amius calculates and monitors its commodity PRR. Amius does not deem it necessary to calculate Interest rate PRR or Option PRR given the current nature of trading book activities undertaken in its business activities.

Amius carries limited foreign exchange exposure, largely as a result of income earned in currencies other than its functional and reporting currency, and overheads being incurred in a range of different currencies. Consequently Amius calculates the relevant Foreign Currency Position Risk Requirement for its Pillar 2 capital requirement.

Interest Rate risk

Although the Firm carries significant cash balances on its Balance Sheet, there is currently no significant exposure to Interest Rate fluctuations.

Remuneration

Amius is subject to the FCA rules on remuneration set out in SYSC 19. The rules aim to ensure greater alignment between risk and individual reward, discourage excessive risk taking and support positive behaviours and a strong and appropriate conduct culture within firms.

Amius’ remuneration policy applies to all staff, irrespective of seniority. Remuneration is both fixed (e.g. salary) and variable (e.g. bonus, severance) and is provided to attract, motivate and maintain high-calibre employees whilst at the same time promoting sound and effective risk management.

Fixed remuneration is relative to the individual’s knowledge and competency and is generally benchmarked to industry standards. Variable remuneration aims to recognise individual performance and overall contribution to the firm whilst still applying strong risk management and appropriate conduct. This is assessed at a minimum, on a quarterly basis through an appraisal process.

Amius are a Level 3 firm and therefore adopt a proportionate approach in respect of the Remuneration Code Principles to the extent it is permitted to do so. Amius do not therefore consider it proportionate to adopt a formal Remunerations Committee given the size of its business. Remuneration is therefore determined by Amius’ Board of Directors. Factors they consider when making their assessment include profit, conduct, risk and compliance metrics.

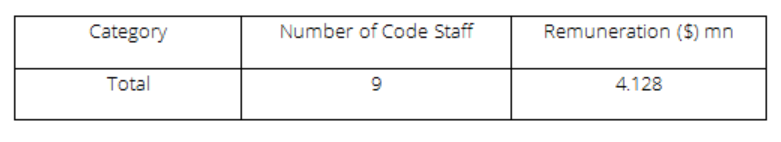

FYE ending 30 September 2017

- No sign on bonuses were paid to Code Staff

- No severance payments were made to Code Staff